As noted in this space prior breaking down reports from Goldman Sachs, Soc Gen, and others over the last three years; the following can be restated: China's central bank and related entities appear to be buying far more gold ( up to 10x more) than they officially report, creating a large and opaque source of demand that is closely tied to a broader effort to reduce exposure to the US dollar and that helps explain the current record bullion prices.

Our latest breakdown below is based on some reporting by the Financial Times, in particular Leslie Hook's excellent work breaking down a SocGen piece titled "China's secretive gold purchases help fuel record rally," and organizes the FT's findings and sourced views into a structured framework with our own past proprietary analysis embedded for understanding the scale and implications of these flows as we have warned multiple times over the last 3 years following the 2022 invasion of Ukraine and confiscation of Russian Wealth.

Let's Begin by Re-Summarizing:

1. Underreported Buying and China's De-dollarization Objective

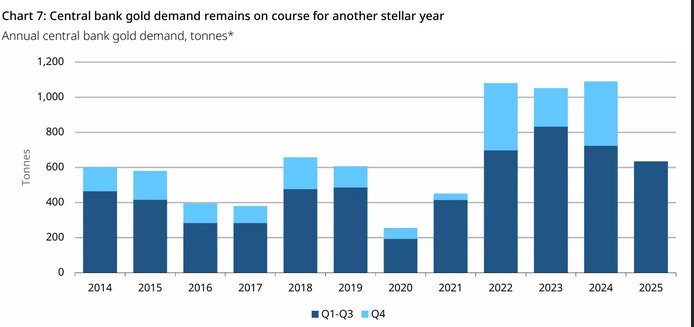

Official data from the People's Bank of China (PBoC) suggests only modest monthly additions to reserves, with single digit tonnage increases reported for recent months. Analysts quoted by the FT argue that these figures dramatically understate reality. Société Générale estimates that total Chinese official purchases could reach roughly 250 tonnes this year, which would represent more than one third of global central-bank demand.

The FT's sources interpret this accumulation as a deliberate component of China's strategy to diversify reserves away from the dollar. Jeff Currie, chief strategy officer of energy pathways at Carlyle, links the buying directly to this policy objective, noting that he does not attempt to pin down exact volumes because of the difficulty of tracking bullion movements:

"China is buying gold as part of their de-dollarisation strategy," said Jeff Currie, chief strategy officer of energy pathways at Carlyle, who says he does not try to guess how much gold the People's Bank of China is buying.

Unlike oil, where shipments can be observed via satellites and shipping data, physical gold is more easily moved and stored without leaving a transparent trail. This structural difference underpins the uncertainty around the precise size of China's purchases and supports the argument that the official numbers are only a fraction of the true picture.

2. Central Bank Demand, Opacity, and Market Impact

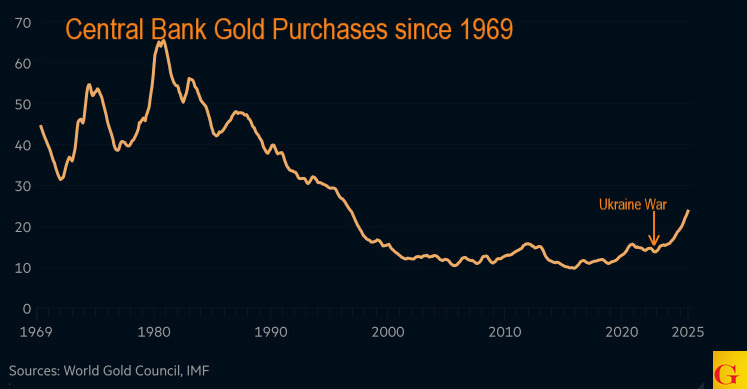

China's behavior is taking place in a wider context of robust central-bank demand for gold. Over the past decade, the share of gold in global reserves outside the United States has increased from roughly one tenth to about one quarter, making gold the second-largest reserve asset after the dollar according to World Gold Council data, and coinciding with spot prices above 4,300 dollars per troy ounce.

However, the transparency of this central-bank activity has deteriorated. The FT cites estimates showing that only about one third of official gold purchases were reported to the IMF in the most recent quarter, compared with around 90 per cent four years ago. This means that a growing share of the marginal price-setting demand is hidden from straightforward statistical sources.

Several reasons for this secrecy are discussed. Some central banks may wish to avoid moving the market against themselves by signalling large purchases in advance. Others may be concerned about political repercussions, especially where bullion buying is interpreted as a hedge against the dollar at a time when relations with Washington are sensitive. Nicky Shiels, analyst at MKS Pamp, frames the calculus in those terms:

"It makes sense to just report the bare minimum, if need be, for fear of reprisal from the US administration," said Nicky Shiels, analyst at Swiss refinery MKS Pamp. "Gold is seen as a pure USA hedge. In most emerging markets it is in central banks' interest to not fully disclose purchases."

The FT recalls the example of the United Kingdom's gold sales under then chancellor Gordon Brown, where advance signalling coincided with depressed realized prices. That event is historically referred to as "Brown's Bottom in Gold. That episode is cited as a case study of how transparency can work against the seller. In the current environment, the combination of political sensitivity and market impact gives central banks strong incentives to keep activity opaque.

Michael Haigh of Société Générale summarises the challenge for traders trying to interpret this environment:

Michael Haigh, an analyst at Société Générale, said this opacity makes the gold market "unique and tricky" compared with commodities such as oil, where Opec plays a role in regulating production.

Without reliable visibility on central-bank flows, price discovery for gold rests increasingly on models and proxies rather than direct reporting.

The two banks differ significantly back in 2016

3. Reconstructing China's True Purchases

Because China's official figures are widely viewed as incomplete, analysts and market participants have developed a series of indirect methods to gauge actual demand.

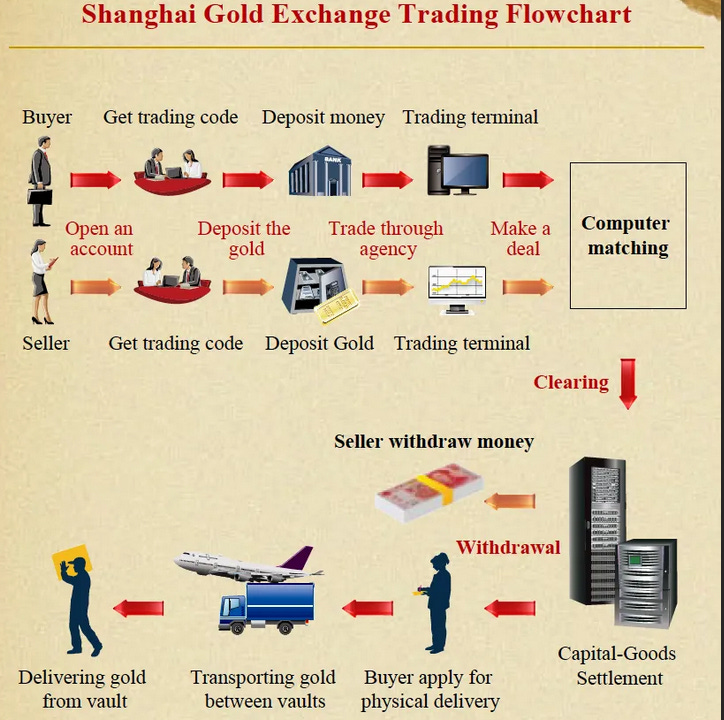

One approach described in the FT is to monitor orders for freshly cast 400 ounce bars with consecutive serial numbers. These bars are typically refined in Switzerland or South Africa, routed through London, and then shipped on to China. Elevated activity in this specific bar segment is taken by traders as an indication of official or quasi official buying.

Market practitioners interviewed by the FT also place little weight on Beijing's published reserve numbers. Bruce Ikemizu of the Japan Bullion Market Association estimates that China's true gold holdings are already roughly double the official total:

"This year, people are really not believing the official figures, especially about China," said Bruce Ikemizu, director of the Japan Bullion Market Association, who believes China's current gold reserves are nearly 5,000 tonnes, double the level it publicly reports.

On the institutional side, the State Administration of Foreign Exchange (Safe), which is part of the PBoC, officially manages the reserve accumulation program and reportedly operates with one year and five year targets. Yet the FT notes ( as this publication's author has broken down multiple times going back to 2017 in detail) that actual buying is conducted through multiple channels.

When you combine the public Gold reserves of China with the Gold controlled by the PBOC through owned or controlled intermediaries, China [already] may have as much Gold or more than the USA publicly claims it has. From: So how much Gold does China own or Control?

In addition to SAFE and its intermediaries, entities such as China Investment Corporation (CIC), the sovereign wealth fund, and the military are also said to purchase gold for reserve purposes, without any obligation to disclose positions promptly. The army we would remind casual observers, has a balance sheet separate from the government and is encouraged to buy gold for its own sovereignty within China. Hat Tip to James Rickards who hinted at this years ago in his book.

Société Générale's estimate of roughly 250 tonnes of imports this year is derived from UK export data, since large bars used by central banks are mainly traded in London. Another methodology discussed in the article comes from Plenum Research, which focuses on the "gap" between China's net imports plus domestic mine production and the visible accumulation by commercial banks and retail consumers. The residual is treated as an approximation of official buying. Using this approach, Plenum calculates official demand on the order of 1,300 tonnes per year in 2022 and 2023, far exceeding declared volumes.

China's status as the world's largest gold miner reinforces the challenge, because authorities can choose to source reserves from domestic production as well as from imports, further complicating efforts to track flows through customs data alone.

4. External Gold Relationships and the Limits of "Knowability"

Beyond its own reserves, China is also positioning itself as a custodian for the gold of developing countries. The FT reports that Cambodia recently agreed to place newly purchased gold, paid for in renminbi, in a vault of the Shanghai Gold Exchange in Shenzhen, according to a person close to that arrangement. This illustrates how China's gold market infrastructure is used not only for domestic reserve management, but also as a storage hub for partners who are increasingly transacting in Chinese currency.

At the same time, the article emphasizes that many experienced analysts decline to offer precise estimates of PBoC purchases, because they regard the underlying data as fundamentally incomplete. Adrian Ash of BullionVault captures this view of structural uncertainty:

"It's ultimately unknowable," said Adrian Ash, research director of BullionVault, an online trading platform. "Any apparent route to figuring it out . . . misses the problem that it is only one part of the enigma wrapped in the riddle which is China's bullion market."

This framing underscores the core conclusion of the FT piece and one this publication has asserted for years with evidence. China's gold market consists of overlapping channels that include the central bank, foreign-exchange authorities, sovereign funds, the military, domestic miners, and offshore trade routes, all operating with varying degrees of transparency. The combined result is a large and persistent source of demand that is crucial for understanding gold's record rally, yet that remains only partially visible even to specialists.

Don't miss out on the opportunity to invest in Gold & Silver. Check out our featured companies today: (Ad)

Augusta Precious Metals — Named “Best Overall” by Money Magazine and trusted by high-net-worth investors. Augusta specializes in premium IRA and 401(k) rollovers, offering direct access to educational 1:1 web conferences and U.S. Mint-approved gold and silver.

- Minimum Investment: $50,000

- Fees: $0 storage up to 10 years

- Rating: ★★★★★ (A+ BBB, AAA BCA)

Goldco — With over $2 billion in precious metals placed for customers, Goldco is a leading name in Gold & Silver IRAs and direct bullion purchases. Known for its strong buyback program and industry awards, Goldco offers both IRA and non-IRA investments.

- Minimum Investment: $25,000

- Buyback Guarantee: Yes

- Rating: ★★★★☆ (A+ BBB, AAA BCA)

American Hartford Gold — Ranked #1 Gold Company on Inc. 5000, endorsed by Bill O’Reilly and Rick Harrison. AHG offers flexible IRA rollovers and direct gold & silver purchases, serving over $2B in precious metals to clients nationwide.

- Minimum Investment: $10,000

- Endorsements: Bill O’Reilly, Rick Harrison

- Rating: ★★★★☆ (A+ BBB)