COMEX Open Interest Revisions Show Major Signs of Market Stress Open interest (OI) is a foundational futures-market metric. In normal conditions, daily revisions are small and reflect basic reporting corrections. Over the past year, however, COMEX gold OI revisions have become larger, more frequent, and more structurally concerning.

Key Observations

• Revisions have escalated from normal levels of 200‒300 contracts to extreme levels nearing 33,000 contracts.

• The largest corrections consistently occur on Mondays, indicating Friday trades are not being fully reported.

• During the U.S. government shutdown̶when weekly CFTC data was unavailable̶OI revisions spiked sharply.

• This pattern aligns with periods of reduced regulatory visibility.

Why This Matters

Only major clearing members, large banks and institutional house accounts have the operational ability to delay reporting at this scale. Such behavior is often associated with:

Concealing significant trading losses

Operational or capital stress

Obfuscating the direction or size of trades

Delaying compliance reporting to gain time

Systemic Implications

Large and persistent revisions undermine the reliability of COMEX data. This threatens:

Market Transparency

Exchange Integrity

Dollar Influence in global commodity pricing

Bottom Line

The magnitude and consistency of these revisions indicate systemic stress, not clerical noise. If unaddressed, these behaviors may lead to a structural decline in U.S. gold-market leadership, echoing the deterioration previously seen in London

I. Why This Matters

Purpose of Analysis

We are going to examine a phenomenon inside the COMEX gold market that should not be happening in an electronic clearing environment.

Specifically:

Open interest revisions are rising sharply.

Revisions are largest on Monday for the previous Friday.

Since the government shutdown, revisions have become extremely large, in some cases reaching tens of thousands of contracts, far above historical norms.

A large entity or entities is either spoofing data or is grossly negligent in reporting trade data to the Comex daily for months, and Comex must know it.

The logical reason for intentionally mis or underreporting data to an exchange is to obfuscate intent and undermine transparency

The logical reason for Comex to know of this (if they do) and do nothing implies there is a bigger problem.

https%3A%2F%2Fsubstack-post-media

Why You Should Care

This is not a technical footnote. Persistent open-interest revisions indicate:

A failure in internal risk controls

Stress at one or more clearing members

Potential obfuscation of losing positions

A threat to the liquidity pool that underpins U.S. dollar commodity pricing

II. How Open Interest Works

A. Definition

Open interest = the number of outstanding contracts that exist at the end of the day.

Every futures contract has two sides: a long and a short.For every matched pair, open interest increases or decreases depending on what the participants already held.

B. The Three Possible Outcomes

1. Open Interest Goes Up

A new long meets a new short.Both sides increase exposure.

2. Open Interest Goes Down

An existing long sells to an existing short covering.Both sides reduce exposure.

3. Open Interest Goes Sideways

An existing long sells to a new long, oran existing short buys from a new short.One side adds, the other liquidates.

From these three states, a knowledgeable participant can infer whether a counterparty is making or losing money if they study daily changes closely.

III. What Creates Revisions: The Out-Trade Mechanism

A. Normal Clearing Behavior

At the end of the trading day, COMEX publishes a preliminary change in open interest.This number reflects matched trades the system recognizes.

Minor revisions occur because:

• A trade was input incorrectly• A trader submitted their side but the counterparty did not• A floor trader historically made a mistake, creating what the exchange calls an "out-trade"

Historically, these revisions are small because electronic clearing matches both sides immediately.Out-trades are now rare.

B. What an Out-Trade Is

An out-trade occurs when:

• The buyer reports the trade• The seller fails to report• Or vice versa

The exchange must treat the reported side as real.Therefore, if a long reports selling but the short does not report buying, open interest must temporarily rise until the missing counterparty is resolved.

This used to happen more frequently during floor-trading days, but in modern electronic clearing, persistent breaks are an anomaly.

IV. What Has Been Observed in the Past Year

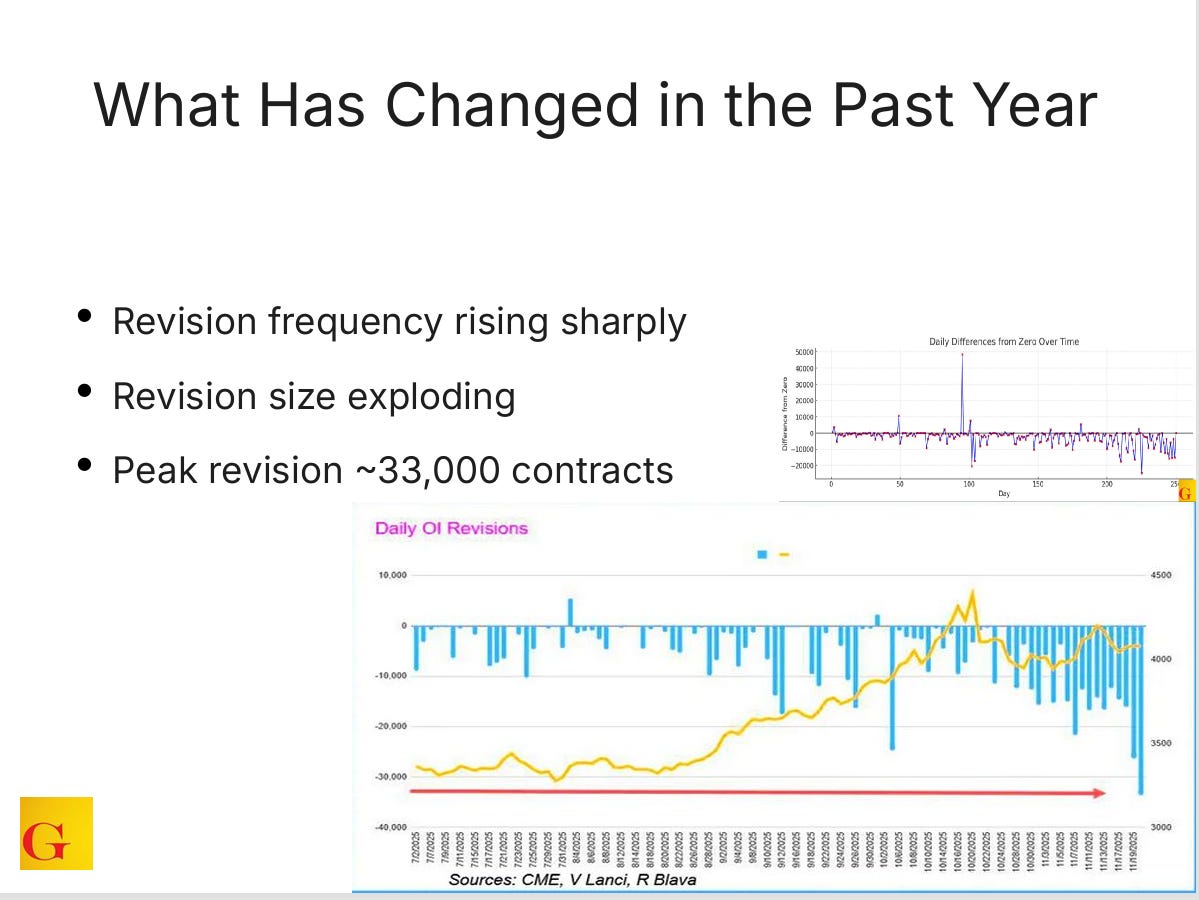

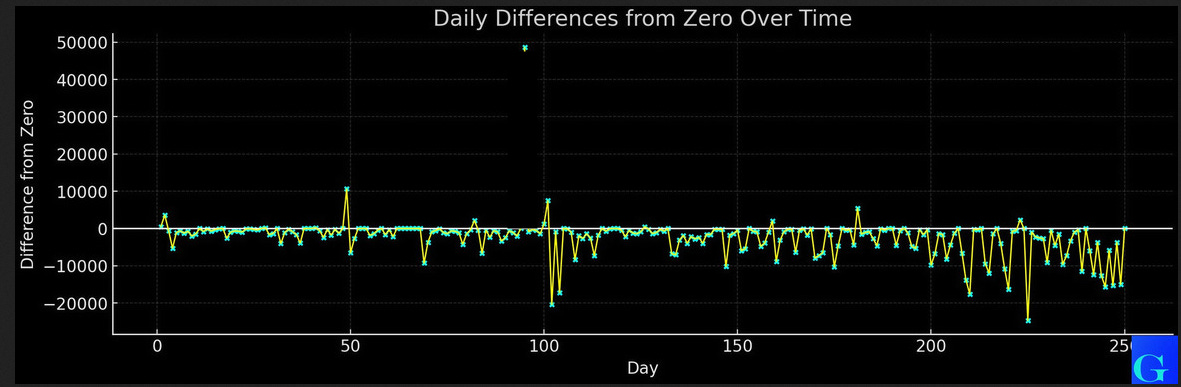

A. Revisions Are Increasing Sharply

The average revision size used to be:

200-300 contracts

During the past year:

Revisions have trended upward

They now regularly reach thousands

They peaked at ~33,000 contracts

This is not a normal statistical variation.It is a sign of stress.

B. Friday Trading → Monday Revisions

The largest revisions consistently appear when:

• Trades happen Friday• Revisions occur Monday

This timing is suspicious because:

Friday is the day you would delay reporting if you wanted to hide a losing position.

Sunday night trading is influenced by what people believe happened Friday.

A counterparty can exploit information asymmetry about your Friday trades during the thin Sunday session.

C. Government Shutdown Period

During the government shutdown, weekly CFTC positioning data stopped.

At the exact same time:

• Open interest revisions exploded• Revision frequency accelerated• Revision volume expanded dramatically

Correlation does not prove intent, but the pattern is classic for a system under pressure when regulators are temporarily blind.

V. Why This Is Dangerous

A. Systemic Risk Indicator

Large and persistent out-trades imply:

• A clearing member cannot or will not properly submit trades• A house account may be hiding the true size or direction of its positions• Compliance controls are being bypassed• Risk officers are either overwhelmed or unaware

B. Why Only Certain Entities Can Do This

Most firms cannot get away with this behavior.

Only entities with:

• House accounts• Membership privileges• OTC-linked ClearPort integrations• Exchange trust and leniency• Systemic importance

have the flexibility to delay allocation or reporting.

Customers cannot do this.Small dealers cannot do this.Only major banks and clearing members can.

C. Why a Firm Would Delay Reporting

Reasons include:

They are unwinding a losing position and do not want other banks to know.

They are undercapitalized and buying time to find liquidity.

They want to prevent counterparties from inferring their vulnerability.

They want to mask PnL during a period of high stress.

In commodities, counterparties are few.Everyone knows everyone.If the street senses you are bleeding, they will pressure you further.

Delaying reporting is a way to hide the blood.

VI. How the Manipulation Mechanically Works

Step-by-Step Example

A trader is short.

Price rallies.

He buys back to cover.

The long who sells reports the trade.

The short who bought does not report it.

The exchange must assume a new short appeared because they cannot ignore a one-sided execution.

Open interest falsely rises.

If this happens repeatedly, revisions explode.

VII. Why This Cannot Be "Accidental" in 2025

Today:

• Matching is automatic• Allocations are electronic• Trades are audit-tracked in real time• Compliance is instantaneous

There is no legitimate excuse for tens of thousands of misreported contracts.

This is not likely sloppy clerical work.This is intent or distress.

VIII. The Larger Market Context

A. London as a Precedent

LBMA liquidity has fractured.Poor policing, chronic transparency failures, and tolerance for member misreporting gradually shifted liquidity to Shanghai.

When a liquidity hub is compromised:

• It does not collapse immediately• It erodes• Then a sudden failure occurs

COMEX is now showing London-like symptoms under the surface.

B. Implications for U.S. Dollar Power

Commodity pricing is one of the pillars that supports U.S. dollar reserve status.If COMEX gold liquidity fractures:

The West loses control of gold pricing

The U.S. loses a key monetary lever

The dollar loses an anchor that enforces global demand

Asia becomes the primary price discovery center

This is not an academic hypothesis.It is already happening.

IX. Final Assessment for the Class

Key Takeaways

Open interest revisions are a stress signal.

The scale of current revisions is unprecedented.

Only major banks or clearing members have the ability to cause this.

The pattern matches intentional obfuscation of losing positions.

The trend worsened during the government shutdown when regulators were not publishing data.

This behavior threatens COMEX integrity and U.S. commodity-pricing power.

The Real Conclusion

This is not a slow evolutionary shift.This is a crisis that has not been acknowledged yet.

If COMEX continues down this path, the U.S. will suffer the same liquidity fracture London did, and price discovery will relocate to Asia.

About the Author

Vincent Lanci is a commodity trader, Professor of MBA Finance (adj.) , and publisher of the GoldFix newsletter.

Don't miss out on the opportunity to invest in Gold & Silver. Check out our featured companies today: (Ad)

Augusta Precious Metals — Named “Best Overall” by Money Magazine and trusted by high-net-worth investors. Augusta specializes in premium IRA and 401(k) rollovers, offering direct access to educational 1:1 web conferences and U.S. Mint-approved gold and silver.

- Minimum Investment: $50,000

- Fees: $0 storage up to 10 years

- Rating: ★★★★★ (A+ BBB, AAA BCA)

Goldco — With over $2 billion in precious metals placed for customers, Goldco is a leading name in Gold & Silver IRAs and direct bullion purchases. Known for its strong buyback program and industry awards, Goldco offers both IRA and non-IRA investments.

- Minimum Investment: $25,000

- Buyback Guarantee: Yes

- Rating: ★★★★☆ (A+ BBB, AAA BCA)

American Hartford Gold — Ranked #1 Gold Company on Inc. 5000, endorsed by Bill O’Reilly and Rick Harrison. AHG offers flexible IRA rollovers and direct gold & silver purchases, serving over $2B in precious metals to clients nationwide.

- Minimum Investment: $10,000

- Endorsements: Bill O’Reilly, Rick Harrison

- Rating: ★★★★☆ (A+ BBB)

Content quality approved by JPost. JPost oversees the native, paid, and sponsored content on this website and guarantees quality, relevance, and value for the audience. However, articles attributed to this byline are provided by paying advertisers and the opinions expressed in the content do not necessarily express the opinions of JPost.The sponsor retains the responsibility of this content and has the copyright of the material. For all health concerns, it is best to seek the advice of your doctor or a legal practitioner.