Consolidation at $4,000/oz Sets the Stage for a Renewed Rally

Gold prices have stabilized near USD 4,000 per ounce following a brief correction that erased around USD 370 from October's peak. The move appears to reflect fading price momentum rather than any fundamental deterioration in demand. Technical factors and a normalization in open interest have absorbed speculative excess, allowing the metal to regain stability.

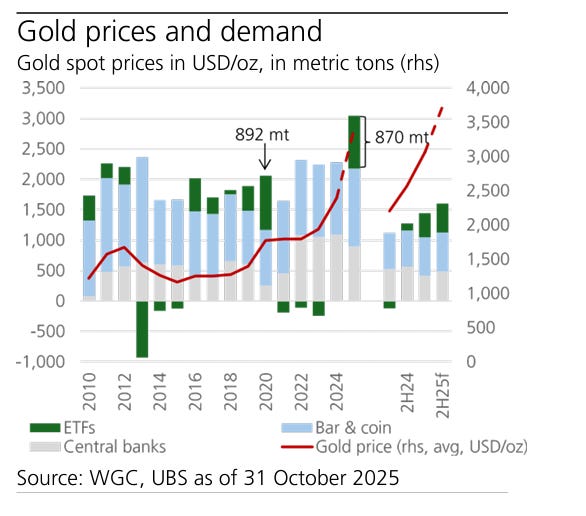

According to a report by UBS, the underlying drivers of gold's advance remain firmly in place. Both investment flows and central bank demand continue to underpin the market. The World Gold Council's latest Gold Demand Trends report [Which we will share this week] showed an acceleration of purchases in the third quarter, particularly from official reserve managers. UBS projects that central banks could add between 900 and 950 metric tons of gold in 2025, a figure lower than the previous three years but still stronger than any year before 2022.

"Two-thirds of central-bank purchases are unreported by the IMF," the report notes, underscoring the opacity and potential persistence of official demand.

Investment Demand Remains Robust

While futures open interest has declined in two distinct waves, UBS observes steady accumulation among investors. Exchange-traded funds increased holdings by about 222 metric tons in 3Q 2025, while bar and coin demand exceeded 300 metric tons for a fourth consecutive quarter. Jewelry consumption also outperformed expectations, suggesting that the correction may be cyclical rather than structural.

"We like buying the dip in gold," UBS strategists wrote, emphasizing that portfolios remain under-allocated to the metal relative to its historical diversification benefits.

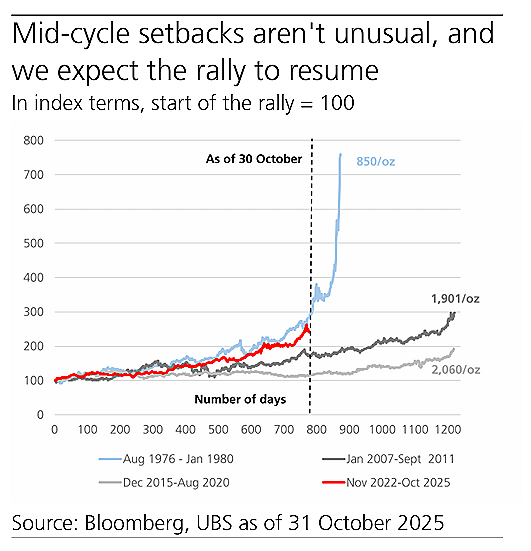

The bank maintains a 12-month target of USD 4,200 per ounce, with an upside scenario of USD 4,700 if political or financial instability intensifies. Mid-cycle setbacks are considered normal within long-term bull markets, and volatility presents opportunities for yield-pickup strategies through option structures.

Macro Backdrop Supports Further Gains

UBS attributes recent uncertainty partly to comments from Federal Reserve Chair Jerome Powell, who expressed less confidence in a December rate cut. Nonetheless, the bank expects additional easing over coming quarters as growth moderates and inflation drifts toward the target range. That policy trajectory should reinforce the appeal of gold as a hedge against both monetary and geopolitical risk.

Portfolio modeling by the firm indicates that a mid-single-digit percentage allocation to gold remains optimal for USD-based investors seeking diversification and inflation protection. In the context of elevated cross-asset volatility, gold's role as a stability anchor appears increasingly valuable.

Bottom Line:

The recent pullback has not altered the long-term narrative. With strong official and private-sector demand, declining real yields, and persistent geopolitical uncertainty, the metal's consolidation near USD 4,000 resembles a temporary pause within an ongoing structural uptrend. UBS continues to recommend maintaining or adding to positions on weakness, positioning for an eventual retest of record highs as the macro environment remains favorable.

About the Author

Vincent Lanci is a commodity trader, Professor of MBA Finance (adj.) , and publisher of the GoldFix newsletter.

Don't miss out on the opportunity to invest in Gold & Silver. Check out our featured companies today: (Ad)

Augusta Precious Metals — Named “Best Overall” by Money Magazine and trusted by high-net-worth investors. Augusta specializes in premium IRA and 401(k) rollovers, offering direct access to educational 1:1 web conferences and U.S. Mint-approved gold and silver.

- Minimum Investment: $50,000

- Fees: $0 storage up to 10 years

- Rating: ★★★★★ (A+ BBB, AAA BCA)

Goldco — With over $2 billion in precious metals placed for customers, Goldco is a leading name in Gold & Silver IRAs and direct bullion purchases. Known for its strong buyback program and industry awards, Goldco offers both IRA and non-IRA investments.

- Minimum Investment: $25,000

- Buyback Guarantee: Yes

- Rating: ★★★★☆ (A+ BBB, AAA BCA)

American Hartford Gold — Ranked #1 Gold Company on Inc. 5000, endorsed by Bill O’Reilly and Rick Harrison. AHG offers flexible IRA rollovers and direct gold & silver purchases, serving over $2B in precious metals to clients nationwide.

- Minimum Investment: $10,000

- Endorsements: Bill O’Reilly, Rick Harrison

- Rating: ★★★★☆ (A+ BBB)

Content quality approved by JPost. JPost oversees the native, paid, and sponsored content on this website and guarantees quality, relevance, and value for the audience. However, articles attributed to this byline are provided by paying advertisers and the opinions expressed in the content do not necessarily express the opinions of JPost.The sponsor retains the responsibility of this content and has the copyright of the material. For all health concerns, it is best to seek the advice of your doctor or a legal practitioner.