China continues to implement a long-term plan to position gold as a foundation for global financing.

To that effect, there have been observed behavioral patterns documented in this space for two years linking: domestic gold liberalization, currency internationalization, and the development of gold as a High Quality Liquid Asset.

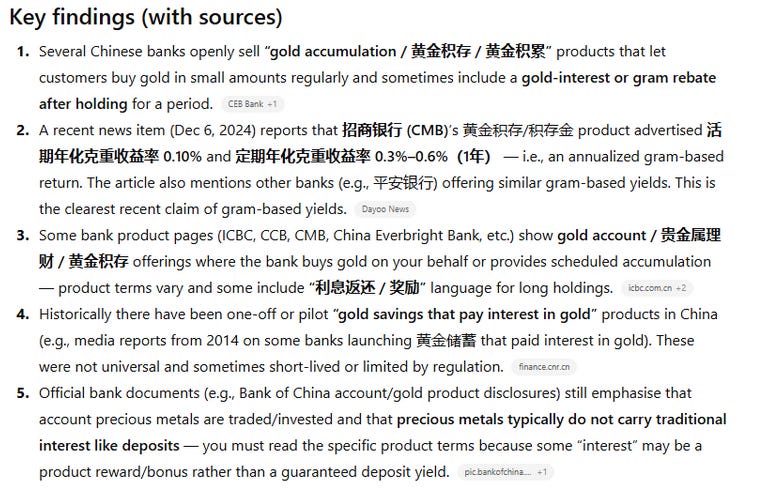

The newest info to that effect is China is now paying interest to Gold holders in Gold itself as seen in the picture above.

The core argument here is that China is expanding the usability of gold while increasing domestic attachment to it within the financial system.

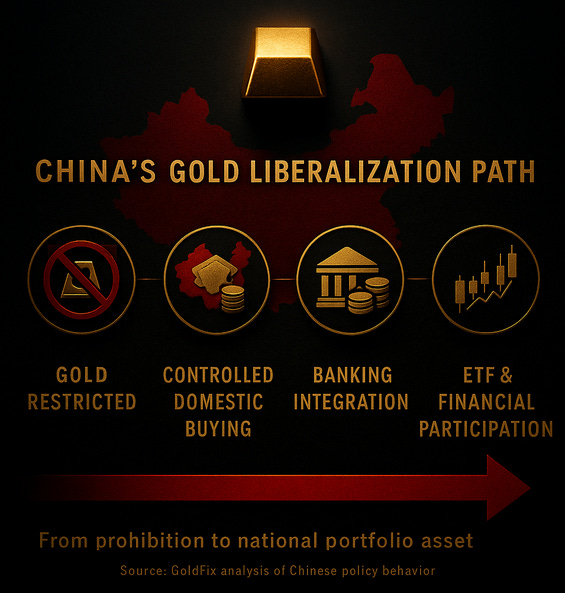

Liberalization of Gold Ownership

Chinese authorities gradually have expanded private access to gold over several years. Citizens progressed from restricted ownership to permission to buy, store, and manage gold within domestic banking channels.

China sends ripples through the global gold bullion market, and no one notices

·

September 26, 2023

The messaging encouraged participation and trust in both state institutions and the gold market. This phase built a broad national base of physical gold ownership while keeping gold inside China's capital controls.

Read full story

"They can now take their yuan and buy physical gold directly from that account."

Linking Gold to the Currency

China deepened the relationship between gold holdings and its currency system. Gold linked accounts and state messaging strengthened alignment of household savings incentives with official strategic goals.

"They needed to get their people to trust them by attaching themselves to the thing that the people trust, gold."

China's domestic gold ETF adoption corresponds with a shift from purely physical holdings to representations of gold within financial structures.

Building BRICS Trust Through Gold Actions

China reinforced credibility among global partners by publicly adhering to stated gold accumulation policies across multiple BRICS summits.

Pursuant to its responsibilities in the BRICS community as well as its own national goals, has taken the position it must finally internationalize its currency more. Until recently, internationalization of the Yuan was a non-starter in China. Yet, as of June 2023, the PBOC began taking public steps to make the Yuan internationally ready.

China will, either implicitly or explicitly back its currency at least partially with Gold as a bridge off the USD and to assuage fears of its BRICS counterparts.

"They have been saying, we are going to do this and they did it."

Gold is used as a policy instrument to secure regional influence and demonstrate reliability to trade partners.

Conversion of Gold into a Financial Asset

A new development identified is interest paid to citizens on gold holdings, in gold. This introduces income functionality to physical reserves and significantly reduces selling pressure.

"It makes them extremely less likely to sell it because it is gathering interest."

The result is a more stable domestic gold base that can support collateralization.

Flow Dynamics and Predictable Accumulation

Guaranteed retention and accumulation of gold introduces flow trade mechanics. Stable inflows provide forward visibility on aggregate demand.

"Flow trades are front running guaranteed inflows or outflows."

Predictable flows support credit expansion using gold as basis collateral.

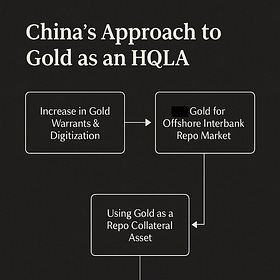

Preparations for HQLA Status

Gold must be stable, widely held, and resistant to liquidation shocks to qualify within sovereign financing infrastructure. We assert that China's behavior indicates these objectives are primary.

"They are making sure capital does not flee."

Bottom up adoption and top down mandate converge into a unified framework for gold backed repo markets.

Continue Reading About HQLA here

*Exclusive: China's Next Move is HQLA/REPO Status

·

Sep 14

This document presents two complementary pieces. Both focus on the evolving role of gold in global finance.Our central finding is that China intends to move gold from its current Tier-1 status toward recognition as a High-Quality Liquid Asset (HQLA), unlocking its use in repo markets and trade finance. Such a change would allow gold to substitute for U.S. Treasuries as collateral within the BRICS system.

Read full story

Toward International Collateralization

China positions gold to enable cross border credit within BRICS aligned markets. We argues that long term demand from trade counterparties will increase as gold enables settlement backed financing.

"China is utilizing accumulation as another reason to own gold."

Persistent accumulation establishes credibility required for foreign holders to treat gold as functional reserve collateral.

China's Bottom Line:

China expands ownership, builds population trust, stabilizes domestic supply, encourages capital formation, and signals permanence to global partners. Each step supports the development of gold as a repo eligible asset within an emerging BRICS financial architecture. The plan increases gold's monetary role while reinforcing the renminbi's international ambitions.

Don't miss out on the opportunity to invest in Gold & Silver. Check out our featured companies today: (Ad)

Augusta Precious Metals — Named “Best Overall” by Money Magazine and trusted by high-net-worth investors. Augusta specializes in premium IRA and 401(k) rollovers, offering direct access to educational 1:1 web conferences and U.S. Mint-approved gold and silver.

- Minimum Investment: $50,000

- Fees: $0 storage up to 10 years

- Rating: ★★★★★ (A+ BBB, AAA BCA)

Goldco — With over $2 billion in precious metals placed for customers, Goldco is a leading name in Gold & Silver IRAs and direct bullion purchases. Known for its strong buyback program and industry awards, Goldco offers both IRA and non-IRA investments.

- Minimum Investment: $25,000

- Buyback Guarantee: Yes

- Rating: ★★★★☆ (A+ BBB, AAA BCA)

American Hartford Gold — Ranked #1 Gold Company on Inc. 5000, endorsed by Bill O’Reilly and Rick Harrison. AHG offers flexible IRA rollovers and direct gold & silver purchases, serving over $2B in precious metals to clients nationwide.

- Minimum Investment: $10,000

- Endorsements: Bill O’Reilly, Rick Harrison

- Rating: ★★★★☆ (A+ BBB)

Content quality approved by JPost. JPost oversees the native, paid, and sponsored content on this website and guarantees quality, relevance, and value for the audience. However, articles attributed to this byline are provided by paying advertisers and the opinions expressed in the content do not necessarily express the opinions of JPost.The sponsor retains the responsibility of this content and has the copyright of the material. For all health concerns, it is best to seek the advice of your doctor or a legal practitioner.