In the financial world, Mohamed Aly El-Erian is well known. The Egyptian-American economist served as CEO of Pacific Investment Management Company (PIMCO) from 2007 to 2014, managing around $2 trillion USD under the Allianz Group umbrella.

Recently, El-Erian posted a tweet that caught the attention of Bloomberg analyst John Authers:

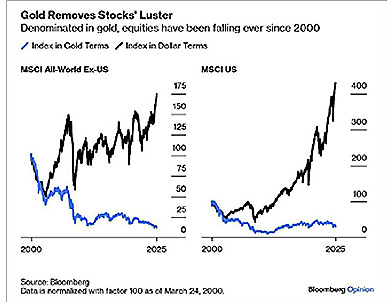

"What if stock-market gains were measured in gold instead of dollars? As John Authers notes, U.S. stocks denominated in gold have been in decline since the dot-com bubble burst 25 years ago. Stocks elsewhere have done even worse."

A single line that summarizes it all: Twenty-five years, no real gain-possibly even a loss.

Nominal vs. Real

The financial system continues to overflow. Paper money endlessly creates new investment opportunities, and central players-banks, fund companies, and asset managers-share a single market built on the illusion of permanent returns.

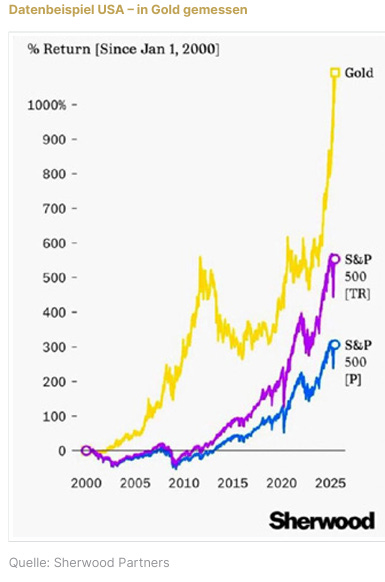

But when measured in gold, the illusion fades. Twenty-five years of promised performance vanish: zero. Negative.

Advisors, analysts, and pension planners thrive on high fees and rich bonuses, confident that few investors ever check the true numbers. Had they done so, they would have realized how little there was to gain and how much illusion filled the space between quarterly reports and reality.

The Illusion of Progress

Financial media celebrate higher stock prices, rising wages, and booming property markets as proof of prosperity. Yet the era of ultra-low interest rates and historic monetary expansion has disguised what was really happening: prices rose because money lost its meaning.

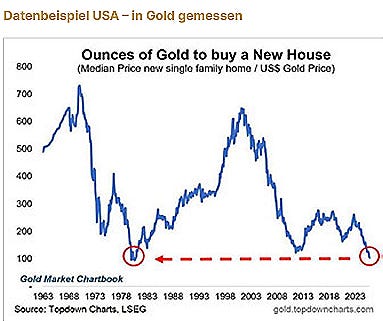

When measured in gold, apparent gains become losses. Stocks, homes, and even currencies like the euro or Swiss franc have all shed real value.

Case Study: Switzerland

A Swiss SMI investment made in 2000 shows a gain in francs but a loss of roughly 50 percent in gold terms.

Real-estate prices, supposedly stable, are also flat or negative once expressed in gold over the same period.

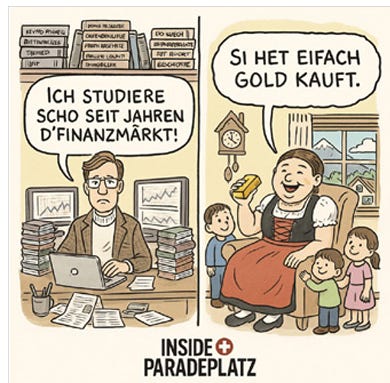

Man: "I've been studying the financial markets for years!" - Woman: "I just bought gold."

The supposed steady increase in wealth was a mirage-fueled by the Swiss National Bank's flood of liquidity and the accompanying era of negative interest rates. The "strong franc" has long since become a monetary fiction.The issue is not the market itself; it is the measuring stick.

El-Erian's Point Revisited

Price growth is the wrong word. It is really purchasing-power decline. El-Erian captures it perfectly: gold doesn't rise; everything else falls.

Measured honestly, twenty-five years of promises deliver nothing. A handful of physical gold coins, quietly stored, outperformed the sophisticated products of the entire wealth-management industry.

While Swiss banks like Credit Suisse and other "pillars of stability" collapsed, unrefined metal kept its value-without balance sheets, scandals, or bonuses.

Gold Measures Truth

Gold pays no interest or dividend because it is money. Its return is not an illusion of compounding but the preservation of purchasing power across generations.

In a world of synthetic finance, that unchanging fact makes it more valuable than ever.

Perhaps that is the real lesson of the past quarter century: gold exposes the truth that paper prosperity tried to hide.

About the Author

Jan Baltensweiler is Senior Manager for German-speaking clients at VON GREYERZ AG, a globally respected precious-metals firm that stores gold for clients in more than 80 countries across Switzerland and Singapore. The minimum investment requirement is CHF 500,000.

Before joining Von Greyerz, he studied business administration and worked in asset management at Credit Suisse in Zurich and Singapore. His expertise lies in tailored precious-metals solutions for European investors and strategic gold allocations in Asia.

Don't miss out on the opportunity to invest in Gold & Silver. Check out our featured companies today: (Ad)

Augusta Precious Metals — Named “Best Overall” by Money Magazine and trusted by high-net-worth investors. Augusta specializes in premium IRA and 401(k) rollovers, offering direct access to educational 1:1 web conferences and U.S. Mint-approved gold and silver.

- Minimum Investment: $50,000

- Fees: $0 storage up to 10 years

- Rating: ★★★★★ (A+ BBB, AAA BCA)

Goldco — With over $2 billion in precious metals placed for customers, Goldco is a leading name in Gold & Silver IRAs and direct bullion purchases. Known for its strong buyback program and industry awards, Goldco offers both IRA and non-IRA investments.

- Minimum Investment: $25,000

- Buyback Guarantee: Yes

- Rating: ★★★★☆ (A+ BBB, AAA BCA)

American Hartford Gold — Ranked #1 Gold Company on Inc. 5000, endorsed by Bill O’Reilly and Rick Harrison. AHG offers flexible IRA rollovers and direct gold & silver purchases, serving over $2B in precious metals to clients nationwide.

- Minimum Investment: $10,000

- Endorsements: Bill O’Reilly, Rick Harrison

- Rating: ★★★★☆ (A+ BBB)

Content quality approved by JPost. JPost oversees the native, paid, and sponsored content on this website and guarantees quality, relevance, and value for the audience. However, articles attributed to this byline are provided by paying advertisers and the opinions expressed in the content do not necessarily express the opinions of JPost.The sponsor retains the responsibility of this content and has the copyright of the material. For all health concerns, it is best to seek the advice of your doctor or a legal practitioner.