Institutional funds like pensions and insurance companies are entrusted with safeguarding the financial futures of millions, bearing the strictest fiduciary duty to act prudently. They must prioritize safety and long-term security, as retirements and even lives depend on their stewardship-a matter of fundamental public trust and social responsibility.

Citizens and institutional giants are being forced into gold and silver. They have no choice but to act in their self interest. As we see start experiencing the slow adoption (gradual) then sudden adoption of Wilson's 20% or Grundlach's 25% gold allocations, citizens, families, insurance funds, pensions, and endowments would require historic reallocations.

Such mandates would trigger enormous capital flows into gold, radically altering benchmarks, portfolio construction, and potentially creating upward price spirals with global systemic implications.If just 20% of the $62 trillion US stock market were reallocated to gold, over $12 trillion could flow into bullion-an amount dwarfing all global central bank gold purchases in history and capable of radically repricing the entire gold market overnight.

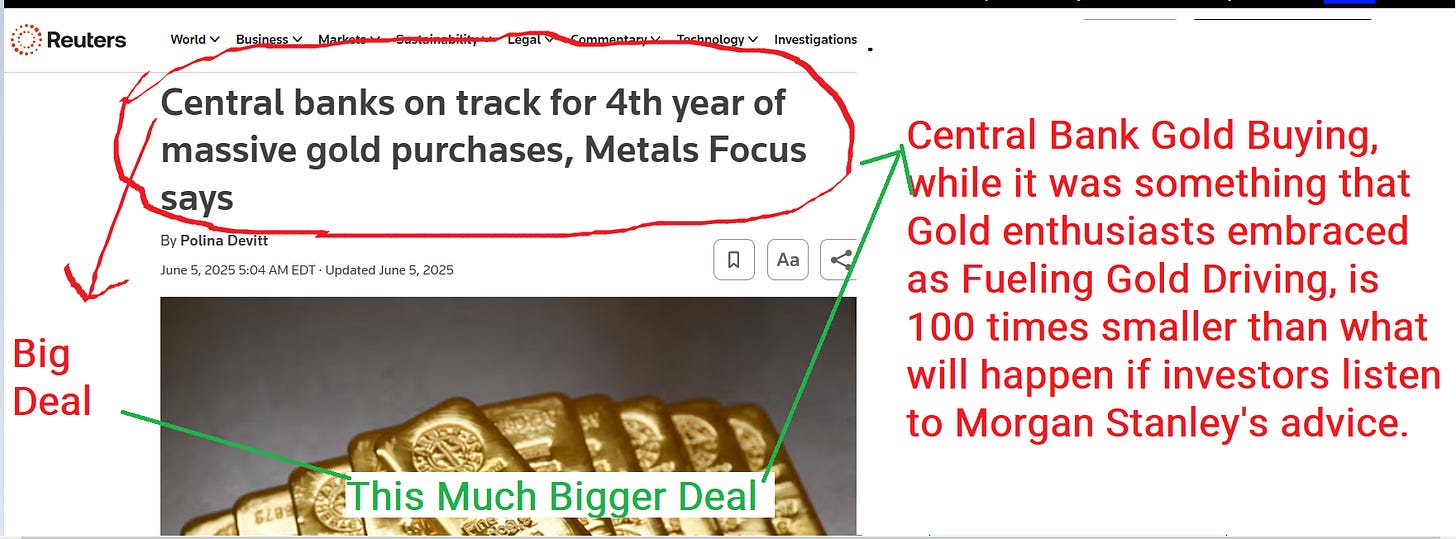

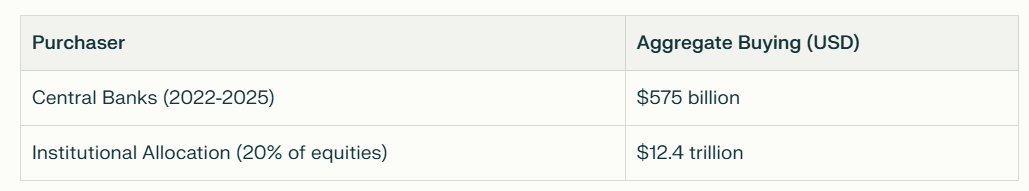

The difference in scale between central bank gold purchases and a scenario where institutions allocate just 20% to gold is staggering. In the past four years, central banks have collectively bought around $575 billion in gold. By contrast, a 20% institutional allocation would mean over $12.4 trillion-over 21 times greater.

Adjusted for just one year the new 60/20/20 rule represents a single year metric of institutional gold buying being 100 times greater than central banks.

A buying wave of this magnitude could create historic price dislocations, potentially sending gold to multiples of current levels, far beyond the effects seen with central bank demand

Gold and silver are poised for an explosive upside, driven by a rare convergence of macroeconomic failures, unprecedented institutional adoption, and evident cracks in the existing policy regime. Recent months have seen silent panic among portfolio managers, with a scramble to add precious metals-and the stocks tied to them-to avoid the embarrassment of missing the year's most powerful trend. The performance numbers are staggering: gold up 43% year-to-date, silver up 59%, and both repeatedly breaking multi-year highs, in direct contradiction to official narratives of subdued inflation and economic strength. This behavior in the metals markets is not just a trade-it is a referendum on the credibility of current fiscal and monetary policy, portending a far larger, system-wide repricing that has only just begun.

Structural Catalysts: Inflation and Policy Failure

The precious metals rally is no fluke. Gold and silver are soaring precisely because they are sniffing out persistent, unaddressable inflation. Despite repeated assurances from both the White House and the Federal Reserve that inflation is under control, market participants are voting with their feet, abandoning dollar assets for real stores of value. If inflation were truly "dead," gold would not be making new all-time highs, and silver would not be revisiting levels unseen for 14 years, all while broad commodities and tech stocks stumble. Rate cuts are still being executed with consumer inflation running well above target, revealing the impotence-and desperation-of policymakers. The official inflation metrics understate the lived reality, as evidenced by rising prices in essentials and services, while the only 'relief' offered is the ephemeral high watermark of stock indices priced in devaluing fiat. In real money terms, the S&P and Dow are collapsing, down over 20% when measured in gold, despite the supposed boom.

Institutional Panic: A Major Portfolio Shift

What truly marks a paradigm shift is Wall Street's embrace of gold as a core institutional asset. Morgan Stanley's overhaul of the classic 60/40 portfolio-moving from 40% bonds to a split between bonds and gold-is a sea change with massive implications. This rotation is not theoretical: it's driven by the realization that bonds are direct casualties of inflation and cannot be defended in the current environment. Institutional money fleeing fixed income for gold is just beginning. With major firms recommending gold for the first time in decades, the tide is turning from isolated "gold bugs" to a herd mentality-one where not owning metals is suddenly a career risk for portfolio managers across the globe. This momentum, combined with deeply compelling valuations in mining stocks and robust earnings growth, signals both value and momentum, a rare combination in modern capital markets.

Policy Drivers: Fiscal Recklessness and Dollar Weakness

Further fueling this precious metals supercycle are disastrous fiscal policies: historic deficit spending, mounting tariffs, regulatory missteps, and open government intervention in capital allocation. New tariffs, unprecedented visa costs, and protectionist policies are doing nothing but adding cost, eroding domestic productivity, and ultimately causing inflation to boil over. Simultaneously, key White House advisors now admit they have no mandate to defend the dollar's exchange value, an open invitation for global capital to dump US assets. As the political pretense of an "independent" central bank falls, so too will any remaining faith in the dollar's purchasing power.

The Inevitable Repricing

The setup is clear. Every major cyclic and structural force now supports far higher gold and silver prices:

Persistent, uncontained inflation and open rate cuts.

Institutional investors capitulating en masse to precious metals.

Policy moves that weaken the real economy and undermine the currency.

Hard evidence of historic outperformance: gold and silver eclipsing not only bonds and cash but even long-hyped alternatives like crypto, which now trails hard assets by a margin so wide it can no longer be ignored.

Against this backdrop, precious metals have become the ultimate "anti-bubble." The window to allocate to gold and silver before the mainstream floodgates truly open is closing rapidly. For those seeking not just protection but real upside in the era of policy failure, the message is unmistakable: own the metals, and own them before the world panics.

Source